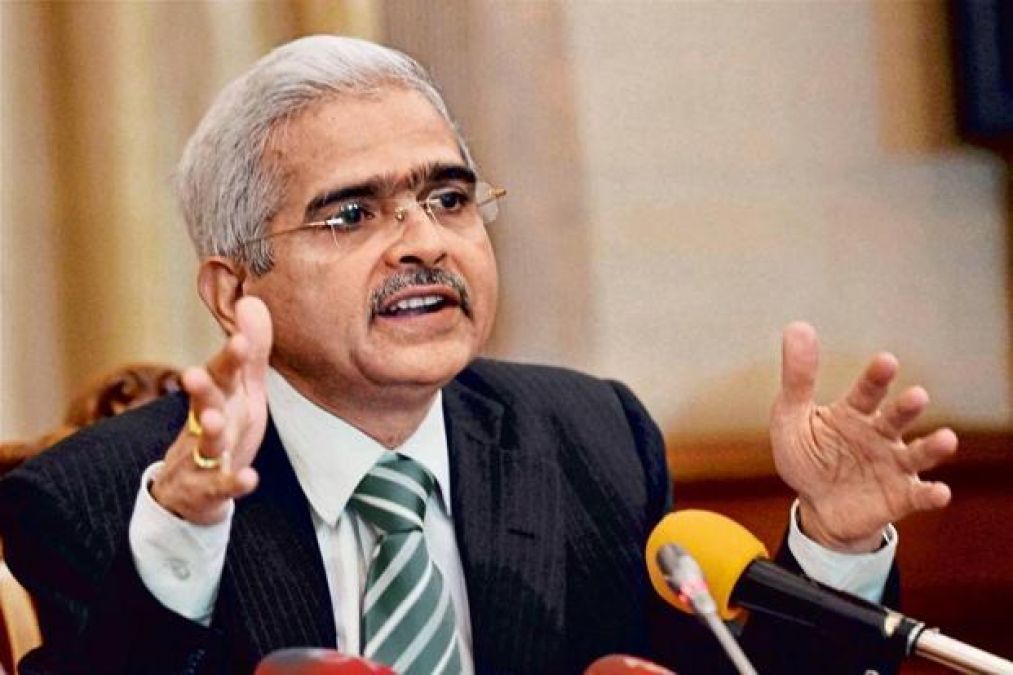

The Reserve Bank of India is set to convene its Monetary Policy Committee (MPC) from December 6th to 8th, 2023, chaired by RBI Governor Shaktikanta Das. This three-day crucial meeting will focus on discussing inflation and other economic factors.

Scheduled for December, the MPC will commence its proceedings on the morning of December 6 and conclude on December 8. RBI Governor Shaktikanta Das will address a press conference following the meeting to communicate the key decisions taken during the deliberations. Comprising three officials from the RBI and an equal number of external members, the RBI MPC meeting holds significant importance.

Expectations for the upcoming meeting suggest that the six-member panel is unlikely to alter the repo rate. The repo rate, which signifies the interest rate at which the RBI extends financial assistance to banks, has been held steady at 6.5 percent during the previous MPC meeting. The RBI had then emphasized its vigilance over inflation metrics.

If predictions hold true, this will mark the fifth consecutive monetary policy meeting where the MPC is poised to maintain the repo rate at 6.5 percent.

Regarding inflation figures in India, the government reported a decline in the Retail Inflation to 4.87 percent in October 2023. Additionally, as per the Union Ministry of Commerce & Industry, the annual inflation rate based on the all India Wholesale Price Index (WPI) for October 2023 stands at (-) 0.52 percent (Provisional) in comparison to (-) 0.26 percent recorded in September 2023, signaling a decrease.

RBI and Bank of England Ink Pact on Information Sharing for Financial Stability