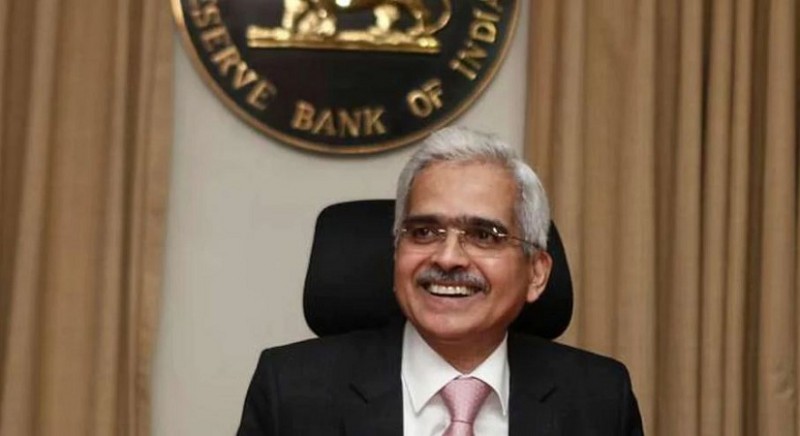

RBI Governor Shaktikanta Das announced Thursday that the RBI's bi-monthly Monetary Policy Committee (MPC) voted unanimously to hold both repo and reverse repo rates unchanged, following the conclusion of its three-day deliberations today.

Concerns over inflation and the COVID-19 omicron variant prompted the RBI to adopt an accommodation policy, which it will sustain as long as necessary for a "durable and broad-based recovery." In terms of projections, the RBI expects GDP to expand 7.8% in fiscal year 2022-23, while CPI (Consumer Price Index) inflation to be 4.5 percent. "Overall, the MPC was of the view that continued policy support is warranted for a durable and broad-based recovery," Governor Das said. "Taking into account the outlook for inflation and growth, in particular the comfort provided by improving inflation outlook, the uncertainties related to omicron, and global spillovers, the MPC was of the view that continued policy support is warranted for a durable and broad-based recovery." The repo rate has remained constant at 4%, while the reverse repo rate has remained unchanged at 3.35 percent.

Some economists predicted that the MPC members would vote to raise the reverse repo rate, which is now at 3.35 percent. Many countries have initiated policy normalisation, and the US Federal Reserve has announced a rate hike cycle that is faster than expected, all eyes are on the RBI. The policy rate was last changed by the central bank on May 22, 2020. Economists and analysts predicted a 20-40 basis point increase in the reverse repo rate.

RBI’s MPC likely to hold rates steady and strive for economic recovery

Inclusion of Aviation Turbine Fuel to raise in GST in next Council meet: FM