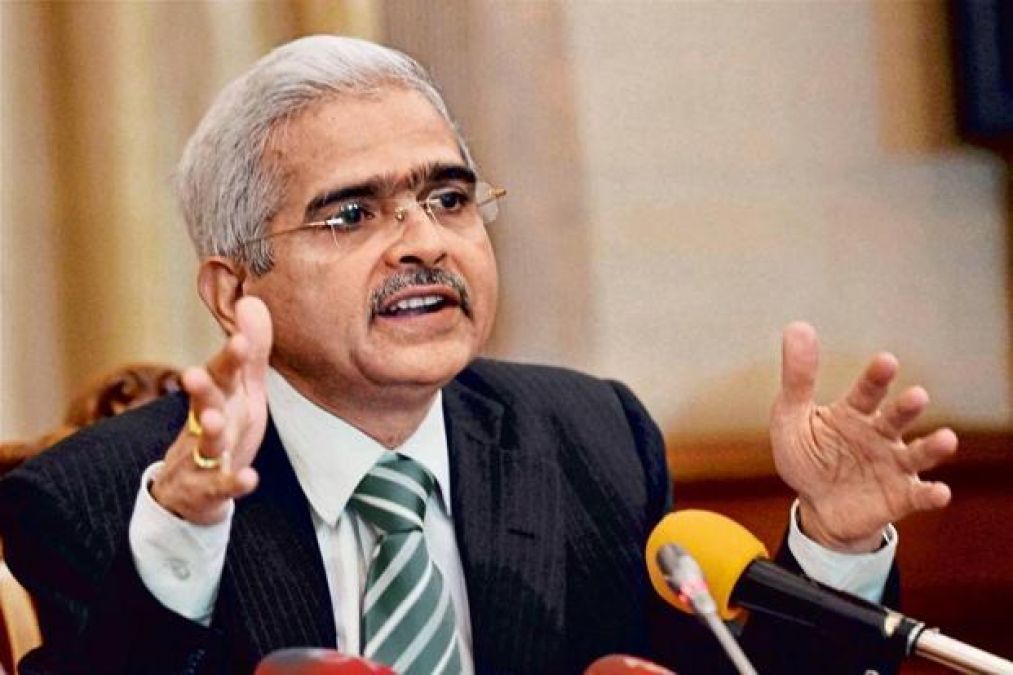

RBI MPC Live Summary: Shaktikanta Das, governor of the RBI, decided to retain the repo rate at 6.5% on Thursday, pushing the pause button for the second time in a row. "Uncertainty on the future course of monetary policy remains as inflation is still high," Governor Das continued. "Headline inflation is easing but still rules above target."

Also Read: RBI MPC Live: RBI maintains Status Quo, Repo rate left unchanged at 6.5%

On Thursday, RBI Governor Das estimated that the GDP would expand by 7.2% and that inflation would be 5.1% for FY24.

For FY2024, 6.5% real GDP growth is predicted. Das predicted that GDP will increase by 8% in the first quarter, 6.5% in the second, 6% in the third, and 5.7% in the fourth.

Also Read; RBI MPC LIVE: RBI Governor to announce policy stance today; will repo rate change again?

In April 2023, the headline CPI inflation rate has decreased to 4.8%. April saw a decrease in CPI inflation, particularly for food, gasoline, and coal. For FY2023, RBI Governor predicted that annual headline inflation would be 5.1%.

For FY2024, 6.5% real GDP growth is predicted. Das predicted that GDP will increase by 8% in the first quarter, 6.5% in the second, 6% in the third, and 5.7% in the fourth.

In April 2023, the headline CPI inflation rate has decreased to 4.8%. April saw a decrease in CPI inflation, particularly for food, gasoline, and coal. For FY2023, RBI Governor predicted that annual headline inflation would be 5.1%.

Also Read: Ahead of RBI Monetary Policy, Rupee opens 4-ps lower at 82.59 against USD