The Reserve Bank of India's (RBI) rate-setting panel on Wednesday began its 3 day deliberations on the next bi-monthly monetary policy amid expectations of at least a 35-basis-point hike in the interest rate to check high retail inflation.

It might be the third consecutive hike in the repo rate or short-term lending rate in the last three months. The RBI has already announced to gradually withdraw its accommodative monetary policy stance.

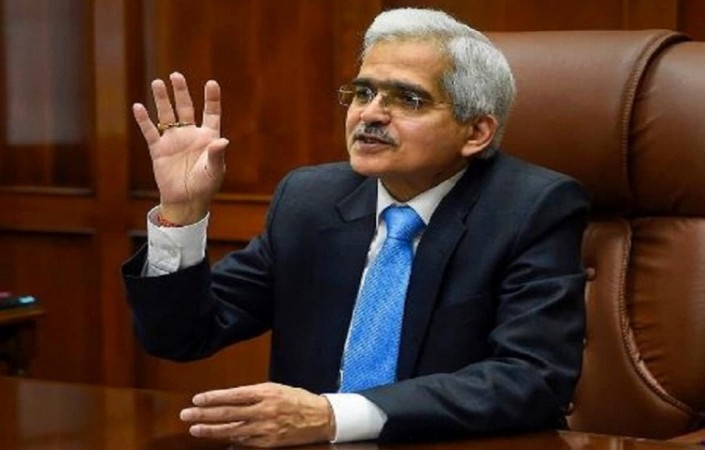

Headed by RBI Governor Shaktikanta Das, the Monetary Policy Committee (MPC) is scheduled to announce its decision on August 5. Both the central bank and the government have been taking steps to contain inflation which is ruling above thye RBI's comfort level of 6 percent since January this year. Finance Minister Nirmala Sitharaman in Rajya Sabha on Wednesday said:

"We have made sure that the rbi and the Government, put together, are taking enough steps to make sure that it is kept in the band of 7 or ideally below 6".

The RBI raised the short-term borrowing rate (repo) twice thus far this fiscal, by 40 bps in May and 50 bps in June to tame retail inflation. The existing repo rate of 4.9 percent is still below the pre-Covid level of 5.15 percent. The RBI sharply reduced the repo rate in 2020 to tide over the crisis induced by the pandemic. Experts are of the view that the RBI would raise the benchmark rate to at least the pre-pandemic level this week and even further in later months.

RBI's FI-index Up; growth across all segments

"Freebies" Announcement by political parties leads to economic disaster: Govt