New Delhi: The Reserve Bank of India (RBI) kept policy rates unchanged on Wednesday, despite concerns over the Omicron form of COVID-19 and excessive inflation. The decision was made today by the RBI's six-member Monetary Policy Committee (MPC), which met from Monday to Wednesday. In October, the MPC held the benchmark policy rates constant as well.

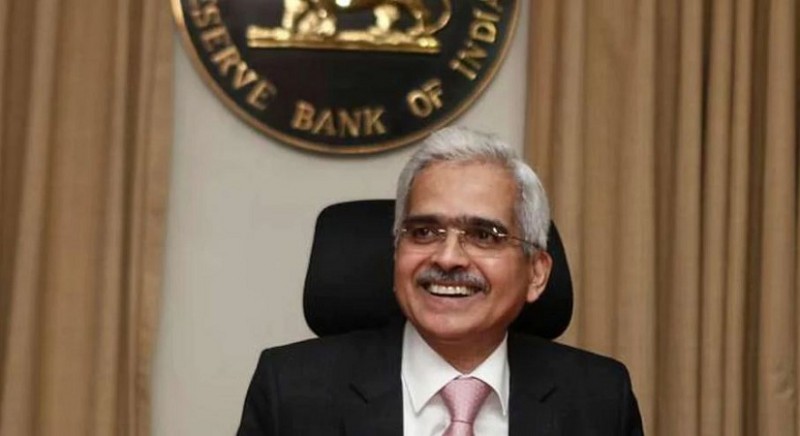

RBI Governor Shaktikanta Das announced the MPC's decision, saying, "The MPC voted unanimously to keep the policy repo rate unchanged, and a majority of 5 to 1 to keep the accommodating policy stance. At 4 percent, the policy repo rate stays constant." The repo rate of the central bank is currently at 4 percent, while the reverse repo rate is at 3.35 percent. The RBI also maintained its 9.5 percent growth prediction for India's GDP in fiscal year 2021-22.

The decision comes at a time when the Federal Reserve of the United States is likely to accelerate the withdrawal of easy money. Fund flows into emerging markets like India will be impacted by a gradual withdrawal of liquidity in US markets and an increase in interest rates in the near future. It may also have an impact on the rupee's value versus the dollar, raising the risk of imported inflation.

Furthermore, interest rate hikes are projected around the world as economies grapple with excessive inflation. Inflation in India's consumer price index (CPI) increased slightly to 4.48 percent in October, up from 4.35 percent in September. For CPI inflation, the central bank has set a goal range of 4 (+-2 percent).

MPC Meet of the RBI begins with hope of maintaining the status quo

RBI is poised to keep rates unchanged over new Covid variant

RBI initiates insolvency process against Reliance Capital