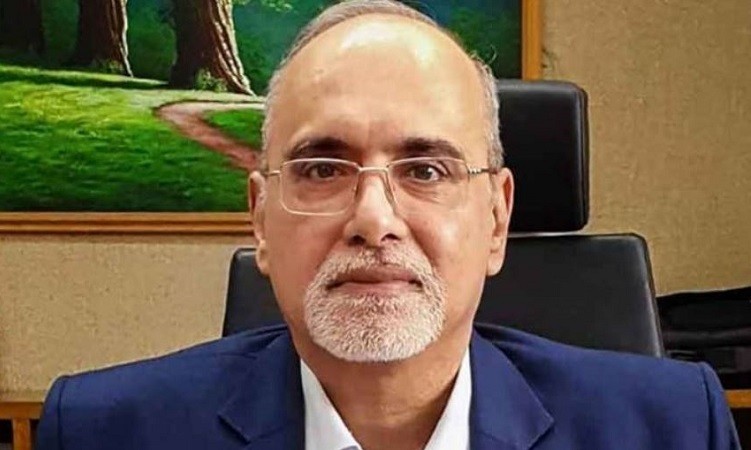

Reserve Bank of India (RBI) Deputy Governor M Rajeshwar Rao said on Monday that India's banking sector has to address gaps in governance frameworks and assurance functions to prepare for upcoming difficulties as the country attempts to become a developed country by 2047.

He stressed that financial institutions will need extraordinary amounts of financial resources to enable growth and actualize the ambitions for a brighter tomorrow while speaking at a recent conference of bank directors held by the RBI.

Financial intermediaries with strong governance frameworks would not be constrained in raising these resources since they can charge a premium for governance. Gaining and maintaining the trust of other stakeholders, like as depositors and different financial resource providers, is crucial in this situation, he said. "This is best ensured by strong governance, control, and assurance functions in financial institutions," he saod.

He also added, "While we all share the goal of effective financial intermediation with beneficial spillover to the real sectors, these ambitions are grounded in a world that is becoming more competitive, diversified, and interconnected. He cited the proverb, which states that repairs should be made to the roof while it is still sunny. "At this point, the Indian banking industry is solid, resilient, and financially strong. Therefore, it would be a good time to fix the plumbing by filling in the holes in governance frameworks and assurance functions and planning for better days to come, he said.

He noted that high performance from management is crucial, but added that it should be accomplished more critically by abiding by appropriate market and customer behaviour as well as optimal corporate governance practises.

"We frequently observe that the Board does not give concerns of conduct the importance or attention that they ought to get. Customer service, consumer behaviour, ethical workplace conduct, data privacy, and cyber security are significant and important concerns that acquire even greater relevance in times of innovation, change, and company disruptions, he said. In these difficult times, he added, "good or rather best practises in these areas are the key soft pillars which build the edifice of a successful financial institution."

Therefore, he stated, it is important to consider the purpose of assurance functions in banks and other financial institutions in relation to these challenges, as well as the expectations from the governance architecture, including the Board and its Committees, Independent Directors, and the Independent Directors.

The regulators typically determine the regulatory perimeter and direct the regulated businesses so that there are no accidents or surprises, he remarked when discussing the connection between regulation and governance.

He said, the Board should determine the strategic direction, interact with management, and undertake a review of important policies and frameworks while the regulators should issue directives for banks to adopt the best practises in terms of governance. "The Boards should manage the alignment of performance with pay as well as enforce accountability to ensure adherence to the best practises while achieving the objectives set for the bank by the Board," he said.