Beijing: Two dozen senior Communist Party officials gathered in rows at the courtyard of Guohong Mansion, which houses China's top economic planning agency, on a chilly morning in mid-January. They were dressed in black coats to ward off the winter chill.

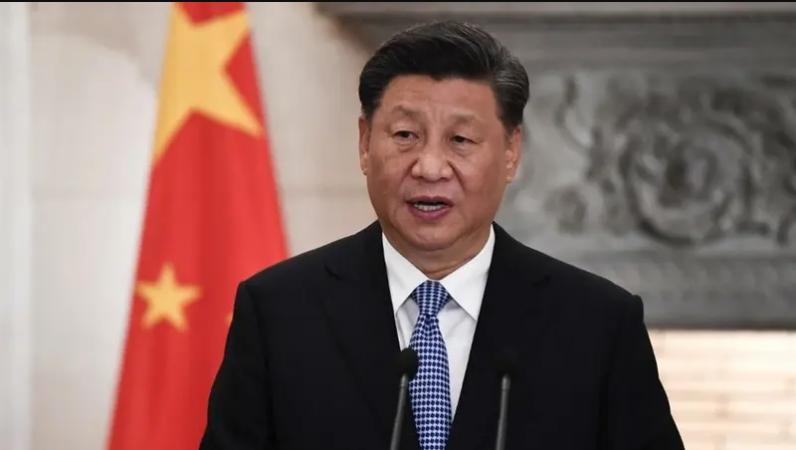

The crowd was there to celebrate the opening of the Xi Jinping Economic Thought Research Centre, the 18th research facility to be founded since the Chinese president's philosophy was enshrined in the constitution in 2018.

China beat expectations and moved closer to unseating the United States as the world's top economy when it revealed its gross domestic product (GDP) had increased 8.1% to 114 trillion yuan (US$16.8 trillion) in 2021. This news came a day earlier.

The ceremony demonstrated Xi's firm hold on power as well as how influential his economic philosophy, known as "Xinomics," had become in China's affairs.

Since taking office in 2013, Xi has implemented an inward-looking economic strategy at home and increased China's economic influence abroad through the Belt and Road Initiative. He has upended important industries and resisted US decoupling threats. Few presidents before him have had the same impact on the economy as he has.

According to Steve Tsang, director of the SOAS China Institute in London, "Xi Jinping is about taking China to a new era and a new direction of travel, under the guidance of his thought, not under Deng Xiaoping's policy line."

Of course, it depends on whether or not he succeeds.

When the 20th Party Congress convenes in the fall, where Xi is most likely to be sworn in for a third term, his economic philosophy will be the topic of discussion.

Historically, the occasion offers Chinese leaders a chance to reflect on previous decisions and establish the course for future growth. Even though the congress is best known for installing a new set of leaders every five years, the economy, which the Communist Party relies on for its legitimacy, frequently takes centre stage in discussions.

Following the Southern Tour led by the late paramount leader Deng Xiaoping, the party picked up its mission of creating a socialist market economy and opening up despite being cut off from the West in 1992.

Entrepreneurs were formally welcomed to the party five years after private businesses were first acknowledged as a significant component of the economy in 1997.

The congress will lay the groundwork this year for Xi's goal of doubling China's GDP and per capita income by 2035, which will serve as the cornerstone for the country's Great Renewal.

addressing "weak links"

China's development is at a crossroads. The economy has been steadily expanding over the last ten years, and the nation is now on the verge of joining the high-income club.

A demographic crisis, sluggish growth, debt, deglobalization, geopolitical tensions with the West, and the coronavirus pandemic are just a few of the challenges it faces.

Xi, who has reshaped the nation's key economic decision-making institutions, most notably the Central Economic and Financial Affairs Commission, will play a significant role in how successfully China navigates these challenges.

In late July, Xi delivered a speech to senior cadres at the Central Party School in which he urged them to "firmly grasp the problems concerning unbalanced and insufficient development, focusing on improving weak links, consolidating foundations, and making full use of our advantages." "To solve them, new approaches and techniques are required."

Liu He, vice premier and chief economic adviser, assisted Xi during his first term, which ran from 2013 to 2018.

These included a large amount of debt, a declining demographic dividend, industrial overcapacity, and inequality, and de-risking campaigns and structural adjustments were high on the agenda.

The trade war with the United States, which caused relations to reach their lowest point in four decades, and the coronavirus pandemic dominated his second term.

In 2020, in response to unrest abroad, Xi changed course with the "dual circulation" strategy, focusing on China's enormous domestic market and indigenous technology to drive future growth. According to some analysts, it signalled a departure from China's long-standing export-driven development model and membership in the international order dominated by the US.

At home, Xi promised to make state-owned enterprises (SOEs) "bigger, better, and stronger" as part of the government's "common prosperity" strategy.

His support for SOEs, which diverged from long-standing calls for reform that prioritised the market, stoked doubts about the role of private companies in the economy. The government's regulatory crackdown on Big Tech and private tutoring only fueled these concerns.

Many foreign investors' confidence has been shaken by Beijing's strict zero-Covid policy and the crackdown on the nation's major tech companies.

According to the annual position paper of the British Chamber of Commerce in China published in May, "recent sporadic outbreaks of Covid-19 across the country and the corresponding snap lockdowns have taken away one of the things most businesses have been able to depend on: a stable and relatively predictable business environment."

When Shanghai's two-month lockdown was just getting started, 372 European businesses participated in a flash survey that revealed 23% of respondents were considering moving current or planned investments out of China.

A number of significant questions regarding the future of China's economy must now be raised as Xi's third term draws closer. What role will ideology play in future development? What will happen to Deng's motto of opening and reform? How will Chinese businesspeople and foreign investors fare in the coming years?

Rich to powerful

The country is transitioning from the Deng era of "Getting Rich" to the Xi era of "Being Strong," according to Taylor Loeb, an analyst with the research firm Trivium China, and his strategy appears to be a mix of wealth redistribution, a focus on self-reliance and supply chain resilience, decarbonization, stability, and quality growth over quantity.

All of the aforementioned is being realised thanks to the state, he claimed. China's economic strategies "will turn inward more."

Under Xi, China's market reform is at a standstill. China Dashboard, a joint initiative of the Asia Society Policy Institute and Rhodium Group that tracks Beijing's reform, reports that in the majority of the 10 major reform baskets outlined in November 2013, there has either been no progress or actual policy regression. Among them are fiscal reform, land reform, competition policies, and SOE restructuring.

In comparison to ten years ago, the assets of state-owned industrial enterprises have increased by 2.6 times to 259 trillion yuan (US$38.3 trillion).

According to Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics, Xinomics includes stronger support for state-owned businesses and more industrial policy, while only mentioning inequality in passing.

He claimed that instead of "serious discussion" of economic reform, past SOE policies like corporatization, debt-equity swaps, and mega mergers were being continued.

But he emphasised that private businesses continue to expand more quickly than their equivalents in government.

Lardy, whose 2018 book the "State Strikes Back" charted the resurgent role of the state in the economy under Xi, said that private investment has held up remarkably well given the policy environment and that their returns have remained much higher.

After the congress, Derek Scissors, a senior fellow at the American Enterprise Institute, predicted that overall economic policy would remain unchanged.

He noted that the Chinese economy started underperforming its growth potential in 2015. "The core of Xi's approach is [that] economics is subservient to politics, that economic gains must be sacrificed if they bring political risks," he said.

incomplete reform

Even though reform may have slowed under Xi, addressing ingrained structural problems is still vital, according to economists.

One urgent task is to narrow the gap between urban and rural areas of the nation. This includes further reforming the hukou system, which places restrictions on where people can live, work, and access public services. Analysts contend that more funding is also required for rural areas.

Urban residents and migrant workers receive various public services. Breaking the dual urban-rural structure is urgent, according to Cai Fang, a well-known labour economist and central bank advisor, who spoke at the Caixin Forum in early July.

Chinese policymakers continue to view urbanisation as a crucial strategy for boosting growth and bridging the gap between the urban and rural areas by luring workers into more productive industries.

The outspoken former mayor of Chongqing, Huang Qifan, declared that the next phase of reform must concentrate on how to create a single market.

According to Huang, who is currently a distinguished visiting professor at Fudan University in Shanghai, "unleashing the potential of the Chinese economy's super-large single market and creating a potent gravitational field for the global economy" are top priorities.

"We need to expand new market space with new policies, a reformist mindset, and practical measures to remove barriers in the economic system and internal circulation."

It is unknown if Xi will heed these warnings. China continues to be a major magnet for foreign investment and remains ingrained in the world's supply chain. However, some analysts believe that refusing to further liberalise the economy could have negative effects.

It is unlikely that economic reform will return to the forefront of policymaking in the near future, according to David Zweig, an emeritus professor at Hong Kong University of Science and Technology.

He claimed that despite the risks foreign businesses may face when they enter the Chinese market, the domestic market in China continues to have a strong gravitational pull on them.

However, China's mercantilism will keep relations with the rest of the world far more hostile than they would have been under a more market-oriented and open strategy as the threat to foreign firms and the economic security of OECD countries becomes more clear.

China’s Growth Sacrifice: Morgan to invest in Chinese assets

Vietnam's impending coffee shortage could drive up prices globally

South Korean businesses in Hong Kong demand a "free and open" business environment