Environmental protection has become a pressing concern in today's world, with climate change and natural resource depletion threatening the delicate balance of our planet. Governments worldwide are actively seeking innovative solutions to address environmental issues effectively. One promising approach gaining traction is the concept of "One Nation, One Tax," a taxation framework aimed at promoting sustainable practices and generating funds dedicated to environmental conservation. This article explores the benefits and challenges of implementing such a tax system and its potential impact on safeguarding the environment for future generations.

The Need for Environmental Protection

The degradation of natural ecosystems, rising pollution levels, and the alarming depletion of natural resources have underscored the urgency for effective environmental protection measures. Governments and policymakers are recognizing that the conventional approaches are insufficient in tackling these complex challenges. There is a need for a comprehensive and sustainable strategy to protect the environment while balancing economic growth.

The Concept of "One Nation, One Tax"

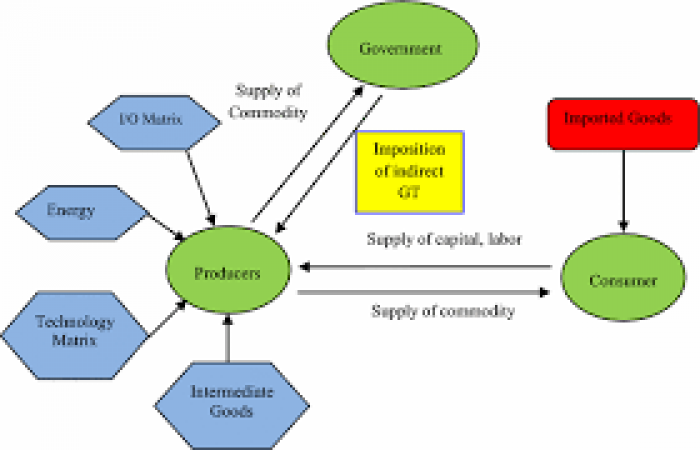

The "One Nation, One Tax" concept proposes the integration of various environmental taxes into a single unified tax structure. Instead of having multiple taxes on different environmental aspects, this approach streamlines the process, making it simpler and more transparent. The revenue generated from this tax can then be earmarked exclusively for environmental protection initiatives.

Advantages of Implementing One Nation, One Tax for Environmental Protection

Simplification of Taxation

One of the key benefits of adopting the "One Nation, One Tax" system is the simplification of environmental taxation. Currently, multiple taxes may exist for carbon emissions, air pollution, water contamination, and waste disposal, leading to confusion and administrative complexities. By consolidating these taxes, businesses and individuals can better understand their obligations, leading to higher compliance rates.

Enhanced Revenue Generation

A unified tax system can lead to enhanced revenue generation for environmental protection. The funds collected through this tax can be utilized to finance projects aimed at conserving biodiversity, developing renewable energy sources, and promoting sustainable practices. Additionally, these funds can support research and innovation to address emerging environmental challenges.

Incentivizing Eco-Friendly Practices

Under the "One Nation, One Tax" system, environmentally friendly practices can be incentivized through tax credits and deductions. Businesses that adopt sustainable production methods, invest in clean technologies, or reduce their carbon footprint may receive tax benefits. This approach encourages industries to embrace greener practices and aligns economic interests with environmental objectives.

Potential Challenges and Solutions

Administrative Challenges

Implementing a new taxation system requires careful planning and seamless execution. Governments may face administrative challenges while transitioning to the "One Nation, One Tax" model. These challenges include updating tax policies, training personnel, and establishing mechanisms for efficient tax collection and allocation. To overcome these obstacles, governments can invest in capacity-building measures and seek expert advice to ensure a smooth transition.

Addressing Opposition

Any significant policy change is likely to face opposition, and the implementation of the "One Nation, One Tax" system is no exception. Some stakeholders may fear increased tax burdens or resist change due to vested interests. Policymakers must engage in effective communication, highlighting the long-term benefits of the tax system and addressing concerns to garner support from various segments of society.

Ensuring Transparency

Transparency is crucial to the success of the "One Nation, One Tax" system. Governments must provide clear information about tax rates, utilization of funds, and the impact of environmental initiatives. Engaging with the public and environmental organizations can foster trust and ensure that the funds are appropriately utilized for the intended purposes.

Case Studies of Successful Implementation

To illustrate the effectiveness of the "One Nation, One Tax" system, let's examine some case studies of countries that have successfully implemented this approach.

Country A

In Country A, the government introduced a unified environmental tax system to combat deforestation, air pollution, and water contamination. By simplifying the tax structure and incentivizing sustainable practices, the country experienced a significant reduction in deforestation rates and a notable increase in renewable energy adoption.

Country B

Country B implemented a comprehensive carbon tax to curb greenhouse gas emissions. The revenue generated from this tax was invested in research and development of clean technologies, leading to breakthroughs in renewable energy and energy-efficient solutions.

Country C

Country C adopted a plastic waste tax to address the growing problem of plastic pollution. By imposing a tax on single-use plastics and encouraging the use of biodegradable alternatives, the country witnessed a substantial reduction in plastic waste generation.

Public Perception and Awareness

For the "One Nation, One Tax" system to succeed, it is essential to create public awareness and garner support. Governments and environmental organizations must collaborate to educate the masses about the benefits of the tax system and the importance of sustainable practices. Additionally, citizens should be encouraged to participate actively in environmental conservation efforts.

The Role of Technology in Environmental Taxation

Technology plays a vital role in the successful implementation of the "One Nation, One Tax" system. Advanced monitoring systems can track environmental parameters, ensuring compliance with tax regulations. Furthermore, technology can foster green innovations, enabling businesses and individuals to find creative solutions to environmental challenges.

Collaboration between Nations for Global Impact

Environmental issues transcend national borders, and collaboration between nations is crucial for global impact. The "One Nation, One Tax" model can serve as a foundation for international cooperation in environmental conservation. By sharing best practices and resources, countries can work together to address pressing global challenges. The implementation of "One Nation, One Tax" measures presents a promising path towards effective environmental protection. By streamlining taxation, incentivizing sustainable practices, and generating dedicated revenue, this approach offers a holistic solution to the complex environmental challenges we face today. With careful planning, transparency, and public engagement, nations can work together to safeguard the planet for future generations.

From Bollywood to Global Stardom: Indian Films' Rise to International Acclaim

India's Economic Odyssey: Unveiling the Present and Envisioning the Future

Embracing the Future: Unraveling the Evolution of Technology and Navigating its Challenge