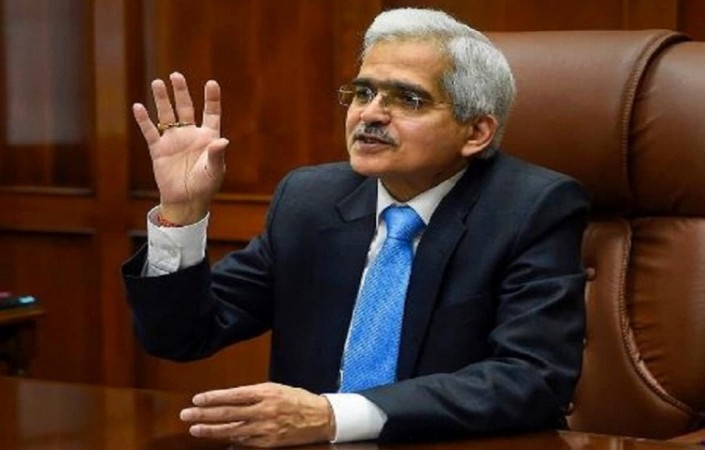

The Reserve Bank of India (RBI) Governor Shaktikanta Das today, April 27, said the Indian banking system has remained resilient and has not been affected adversely by the recent crisis affected in the banking system in some advanced economies.

Addressing a conference on 'Financial Resilience' organised by the College of Supervisors in Mumbai, Governor Das said in the context of the overall impact of the Covid-19 pandemic, the war in Ukraine and the recent banking sector events in the United states and Europe on the financial sector, there is now a renewed focus on issues of financial resilience and stability.

A run on the bank by depositors caused Silicon Valley Bank, one of the most well-known lenders in the world of technology startups, to go under on March 10. Its closure caused other banks to close as a result of a chain reaction.

Regulators and governments around the world are increasingly paying closer attention to these factors. "A nation's financial sector, including its many institutions like banks, non-banking financial firms (NBFCs), and other businesses, must always be resilient, he siad. They ought to possess the inner fortitude to endure even the most trying circumstances. He said that the RBI has recently dramatically tightened its controls over the regulation of banks and other regulated firms in India.

Das stated that "this historical function of providing emergency liquidity assistance to banks and other financial market institutions necessitates that central banks maintain a close watch on banks and financial markets for signs of instability, if any." A bank should, in Das' opinion, have sufficient capital buffers, be able to earn money even during severe macroeconomic shocks, and have enough liquidity to satisfy its obligations.

The RBI has begun thoroughly examining the business strategies of banks. "Deficits or aspects of the business model itself may eventually spark crisis. We have gone above and beyond to encourage banks to build up capital buffers in good times and times of plenty, he added, citing to what it did during the Covid-19 pandemic when there was lots of liquidity. We have prescribed regulatory criteria for capital adequacy and liquidity ratios.

The Ministry of Finance has expressed a similar opinion regarding India's banking system as well. In its monthly review report released on Tuesday, the Ministry of Finance noted that recent bank failures in the US and Europe, which were brought on by the current cycle of tightening monetary policy, primarily because of interest rate increases, raised concerns among policymakers about the vulnerability of financial systems, particularly in emerging market economies (EMEs).

The review report put on April 25 categorically stated that India's banking system is considerably less prone to such incidents. "A discussion of what caused the collapses overseas is beyond our remit, but we will confine to restating the factors that make the Indian banking system considerably less prone to such developments in the near-to-medium term future," the report said.