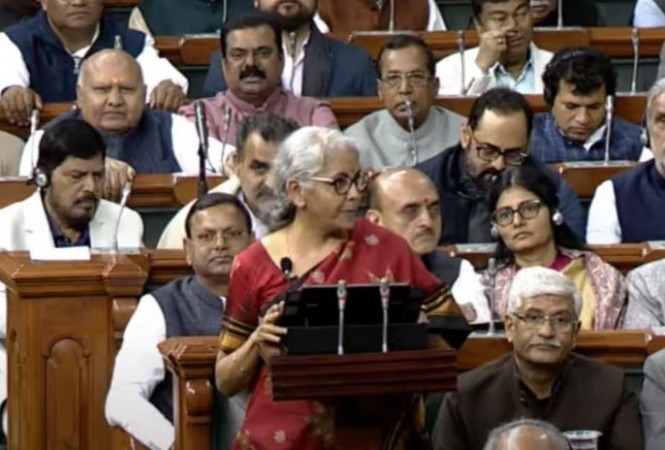

NEW DELHI: Union Finance Minister Nirmala Sitharaman is scheduled to address the Lok Sabha later today on the Finance Bill, with her speech expected to begin around 4 p.m. This discussion follows the recent passage of the Appropriation Bill, which covers the central government's expenditure for the fiscal year 2024-25.

The Finance Bill is a crucial part of the budget process, which will be completed once Parliament approves it. The Finance Minister introduced the Union Budget for 2024-25 on July 23, setting a fiscal deficit target of 4.9% of GDP. The government aims to reduce this deficit to below 4.5% of GDP by 2025-26. Fiscal deficit measures the gap between the government's total revenue and total expenditure.

For the 2024-25 fiscal year, the central government has earmarked Rs.11.11 lakh crore for capital expenditure. This allocation represents an 11.11% increase compared to previous budgets. Capital expenditure, or capex, is used for long-term investments in physical assets.

The Finance Bill has introduced several changes to customs duties, impacting various goods. Notably, imported gold, silver, leather goods, and seafood have become cheaper due to reduced duties. A significant reduction in gold duties is expected to boost retail demand and reduce smuggling.

Additionally, the Finance Bill proposes a full exemption of customs duties on 25 essential minerals and a reduction in basic customs duties on two others. Sitharaman stated that these changes aim to support domestic manufacturing, enhance local value addition, and promote export competitiveness.

On the downside for investors, the Finance Bill includes increases in both short-term and long-term capital gains taxes. Short-term capital gains on certain financial assets will be taxed at 20%, up from 15%. Long-term gains on financial and non-financial assets will now attract a 12.5% tax rate, up from 10%. However, the exemption limit for capital gains on listed financial assets will rise from ₹1 lakh to ₹1.25 lakh per year.

A notable amendment proposed in the Finance Bill will ease the tax burden on property transactions. Taxpayers will have the option to choose between a 12.5% tax rate without indexation or a 20% rate with indexation, based on the lower amount, for properties acquired before July 23, 2024.

In a move to support startups, Sitharaman has proposed the abolition of angel tax, which applies to funding raised by unlisted companies exceeding their fair market value. This change is expected to encourage investment in startups, which are vital for economic growth and job creation.

On July 23, Sitharaman delivered the Union Budget 2024, marking her seventh consecutive budget presentation, surpassing the record of six consecutive budgets held by the late Moraji Desai. The budget session of Parliament, which began on July 22, will continue until August 12.

Chief Economic Adviser V Anantha Nageswaran has projected that India will remain the fastest-growing major economy in 2024-25, with an estimated growth rate of 6.5-7.0%.

Recent Updates:

Union Budget 2024-25: Keeping Balanced Approach to Growth, Job, and Investment, Says FM

PM Modi to Lead Meet on Post-Budget Vision: 'Journey Towards Viksit Bharat'

GST Impact: How Your Everyday Essentials Contribute to Govt Revenue