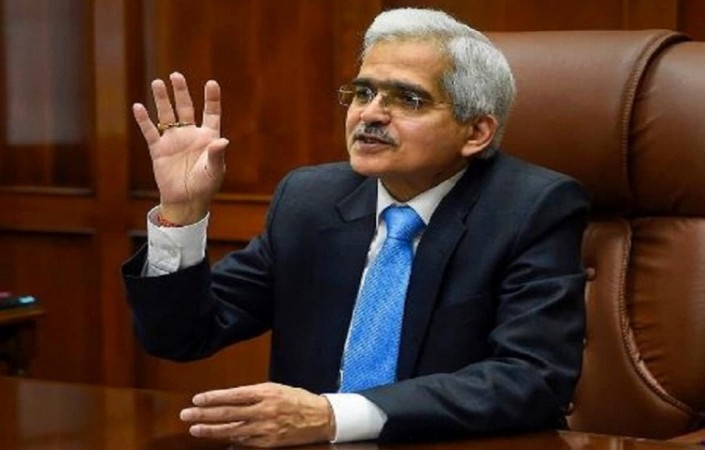

Shaktikanta Das, governor of the Reserve Bank of India, stated during the MPC announcements on Friday that the GDP projection for 2022–2023 has been revised downward to 7%.

In its latest meeting, the RBI MPC predicted a 7.2% GDP growth for the years 2022–2023. He said, the GDP increased by 13.5% in the first quarter, 6.3% in the second, 4.6% in the third, and 4.6% in the fourth. It is anticipated that the first quarter of 2023–24 would expand by 7.2%.

The Governor stated that "downside risks to growth can arise from the headwinds from prolonged geopolitical tensions, tightening global financial conditions, and potential reduction in the external component of aggregate demand."

Despite being less than anticipated, real GDP growth in the first quarter was the highest among major global economies, according to Governor Das, who was speaking about the GDP growth in the first quarter of 13.5%.

While real GDP growth in Q1:2022-23 came in below expectations, he added, "Aggregate demand and output are expected to be supported in H2:2022-23 by the late recovery in kharif sowing, the comfortable reservoir levels, improvement in capacity utilisation, buoyant bank credit expansion, and government's continued thrust on capital expenditure."

Das said, the world has seen two huge shocks in the last 2.5 years - COVID-19 and the Ukraine War. These shocks had a significant effect on the world economy. As if that weren't enough we are currently experiencing a third significant storm as a result of aggressive monetary policy actions and much more aggressive communication, largely from advanced country central banks, he said.

the Governor said India's ‘steely resolve’, its journey in the past 2.5 years, and the withstanding of the shocks of COVID-19 and the Ukraine war have given the country the optimism to face the new storm.

The MPC had predicted a growth of 7.2% in 2022–2023 with a Q1 projection of 16.2% before the GDP growth was reduced. But the Q2, Q3, and Q4 estimates, at 6.2%, 4.1%, and 4.4%, respectively, were lower than today's announcement.

On September 30, the Reserve Bank of India (RBI) declared that the inflation prediction for FY23 remained constant at 6.7%, mostly because of the potential for higher food prices.

On Friday, RBI Governor Shaktikanta Das increased the repo rate by 50 basis points (bps) to 5.90% amid growing worries about increasing inflation, global headwinds, and a drop in the value of the rupee to historic lows. He emphasised that the rate-setting committee is worried about inflation and stated that the central bank is actively monitoring the price situation.

The governor stated that despite global obstacles, including rising concerns about a global recession and high inflation, the Indian economy has remained robust.

Since the beginning of the year, India has experienced substantial inflation. Since January, retail inflation in India has remained above 6%. It exceeded 7% in April, May, June, and August. The tolerance ceiling set by the RBI is 2% to 6%.