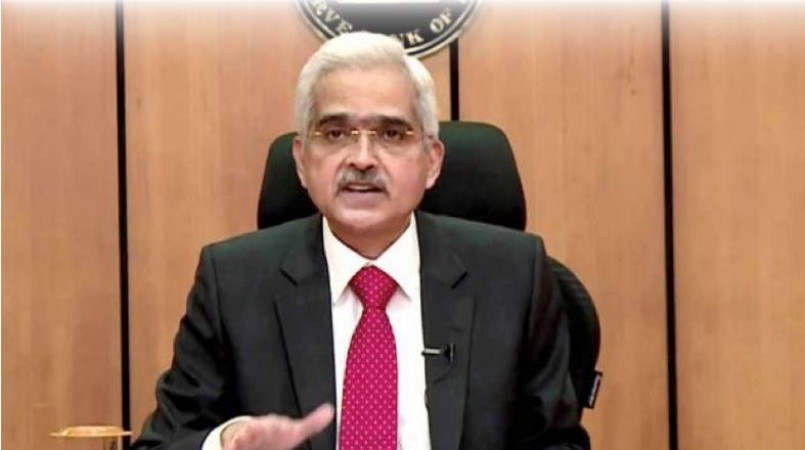

The Reserve Bank of India (RBI) is likely to raise the repo rate by 25 basis points (bps) on Wednesday in its first monetary policy review following the Union Budget 2023. The Monetary Policy Committee (MPC) began its three-day meeting on Monday. Today, MPC decisions are expected to be announced by RBI Governor Shaktikanta Das.

Another rise in the repo rate today?: According to a January 13–27 Reuters poll, 40 out of 52 analysts predicted that the RBI will increase its benchmark repo rate by 25 basis points to 6.50%. At the meeting on February 8, the remaining 12 foresee no change.

With retail inflation showing signs of easing and continuing below the Reserve Bank of India's upper tolerance level of 6%, as well as a projected slowdown in GDP growth in the upcoming fiscal year beginning in April, experts believe the central bank may only choose to raise the benchmark interest rate by 25 basis points.

Another opinion is that the Reserve Bank may press the pause button on rate hike on Wednesday itself.

In a paper titled "Prelude to MPC Meeting on Feb 6-8, 2023," the Economic Research Department of the State Bank of India said, "We expect the RBI to halt in February policy."

The central bank increased the key benchmark interest rate (repo) by 35 basis points (bps) in its review of the country's monetary policy in December, following three consecutive rises of 50 bps.

The RBI has raised the short-term lending rate by 225 basis points since May of last year in an effort to rein in inflation, which is primarily the result of external causes, particularly the disruption of the global supply chain caused by the commencement of the Russia-Ukraine war.

The repo rate is currently 6.25%. For FY23, the RBI raised interest rates for the first time by 40 bps in May, followed by three additional rate increases of 50 bps each in a row from June to October, and then a slight easing to 35 bps in December policy.

RBI likely to settle for 25-bps repo rate hike: Experts

This Bank implements RBI's first phase of Digital Rupee, Know more

Centre hopes dividend of Rs48,000 cr from RBI, PSU banks in FY24