In our endeavour to assess that, if there is any substance in the various theories given for establishing, that some scam is behind the big move of Demonetization; we have made our assessment over major two ‘Scam Theories’ in our previous two articles. Now, we will deal with the two weaker theories used to prove that some scam was there. According to the third theory, the whole exercise of demonetization and then drive for cash-less systems is done “to give banging start to the e-valet companies” such as Paytm. The fourth theory contends that this all was for “saving the public sector banks (PSBs) from the verge of bankruptcy”. Let’s see them one by one.

Theory of ‘Booster for E-Valet Companies’

This theory was propagated after seeing the heavy advertisement and campaigning of few e-valet companies coinciding with the period of demonetization and followed by less-cash drive by government. The coincidence of these two separate phenomena, made many people to assume that the government began these two big moves of demonetization and cash-less; to provide a thumping start to the e-valet companies. Since, one resourceful e-valet company Paytm started its heavy ads - rich campaign, in the same period i.e. in October-December 2016 quarter; it was the obviously main target for accusations under this theory.

But, now the scenario has changed a lot and new facts have come on the fore-front. The Modi Government brought a new app named Bhim, being run by government itself, for cash-less transactions and PSB’s are also in the process of launching their own e-valets; SBI has already launched its SBI-buddy. The accusation was that “the government is unduly supporting the e-valet companies (especially Paytm); so it implies that PM Modi has received big payoff from them”. But it is now itself has lost grounds.

In fact, the government never gave special support or any privilege to Paytm or any other e-valet company. However, Paytm has used PM Modi’s images and short videos in their ads and publicity campaigns. These things/ inputs were already available in public domain and some other e-valet/ digital payment companies have also used them; as there is nothing illegal in it. Government was (and is) only trying to promote less-cash system and e-valets were mentioned as an option in few govt. Campaign instruments. As PM Modi, himself has launched the ‘Bhim App’ and emphasizing over it, so the balloon of this theory is now fully punctured. Reason is very simple that, if PM has obtained any pay off from any e-valet company then he can’t launch and support any such thing which may jeopardize their prospects.

The road map of the ‘Paradigm Shift’

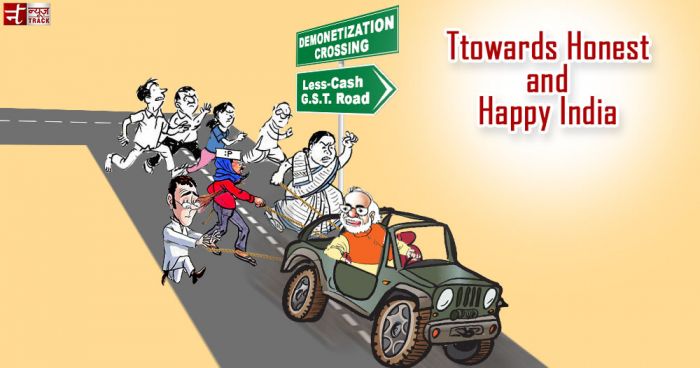

In fact, the government (at-least PM Narendra Modi) has got a clear road map with proper sequence of steps for making India a ‘Digital and Less-Cash country’. Just to recall a few steps, at first they made a call for Digital India, then called a drive for connecting people with banks by opening Jan-Dhan Accounts, then they made first offer of Voluntary Declaration Scheme (VDS for undisclosed assets); then the declaration of demonetization came, followed by the ‘historic long term drive for Less Cash Economy’. Therefore, this can be deduced that the ‘Less-Cash’ drive is the culmination of all these preceding steps; which also have their own various special benefits, too.

All knowledgeable people know that, Less- Cash is the more appropriate term than ‘Cash-less’ system of transactions and it enhances honest dealings by ensuring transparency along with increase in government revenues. Moreover, it is not just like a one time or short term scheme or drive, but it is a long term change in economic culture or in other words it is a ‘Paradigm Shift’ of whole system, forever. So, no short term objective or narrow motive can be equated and connected with it. This can be the thought of only those persons who have prejudices and narrow vision. Hence, the theory of this kind has no ground and no worth.

The Theory of Saving the PSB’s

It was a fact that the Public Sector Banks (PSB’s) were in financial trouble before Demonetization due to heavy burden of NPA’s, caused by the large amounts of unpaid loans. But, there are some questions and doubts about this assumption that ‘they were at the verge of bankruptcy’. It is a matter of factual assessment that, (i) What level of NPA’s can be termed as the ‘danger level’? (ii) Were the banks have surrendered and requested to the RBI and government that now they are unable to improve their health by their own efforts and they can’t recover even so-much part of the NPA’s that they can survive and proceed forward with adopting more effective system for recovering big loan amounts? (iii) The NPA’s were not only due to non-payment by the billionaires, but a substantial part of it was due to agricultural loans and MSME’s loans. In many of these all categories of cases, the banks may adopt middle path of settlements and can also seek help from govt. to provide interim support or subsidy like support for the unpaid loans of some under trouble farmers or some sick units. So, were not there options remained, at the bank’s level itself? (iv) If we assume that, for many cases banks might not have such options; then ‘were not there options at the RBI level, too? (v) If we even assume that no other alternative was remained at the bank’s level and at the RBI’s level even then was there no other better and easier alternative for the government, too?

The answer to the above question is quite clear

It can be claimed with full confidence that, at every level there were better alternatives and if the persons at these levels were not observing such options, then it means that they were not creative and efficient enough. Hence, there is again no sense in the argument that, this huge endeavour was carried out just as a cure for the ill-health of PSB’s. Our counter argument given earlier is valid here too, that demonetization and Less-Cash drive are not short term schemes or drives, but they are long term change in economic culture i.e. a ‘Paradigm Shift’ for ever. So, no short term objective or narrow motive can be equated and connected with them.

But, don’t take it lightly

Now, presently the health of banks have improved a lot, in fact the banks are now flooded with cash. So, now the PSB’s are not in financial trouble due to NPAs; but NPAs do exist and have not been wiped out. Therefor, PSB’s still have responsibility of recovering big loans from various types of defaulters. So, it should be taken still seriously and as the present state of heavy deposits will not sustain for ever; so the bank officials as well as RBI and government must take enough effective steps for recovery of the unpaid loans. Very especially for those loans, which are not being paid by the well known billionaires; because it has now become a big question over the integrity, honesty and credibility of all the authorities from loan/ recovery managers to the level of Prime Minister of India; even if, it is not a question of PM level.

* Hariprakash ‘Visant’

Also Read:

Is there any ‘Scam’ behind Demonetization?

Second theory of ‘Scam Behind Demonetization’: An impartial evaluation

POST DEMONETISATION DISCLOSURE: IT dept detects undisclosed income of over Rs 5300 cr

SC refused for probe of Sahara-Birla Diaries, rejects plea of Prashant Bhushan

'Rahul Gandhi has a lowest intellectual in the Nehru Gandhi's family'; RSS leader Rakesh