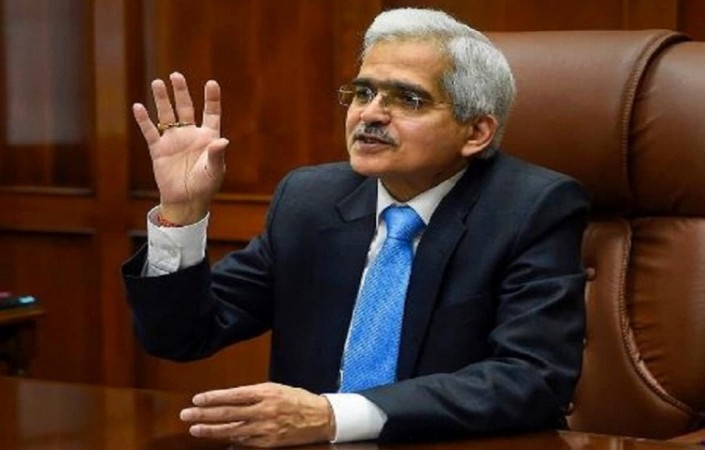

Shaktikanta Das, Governor of the Reserve Bank of India (RBI), will be more concerned as a result of the US Federal Reserve's decision to raise short-term interest rates by 75 basis points to 2.25 to 2.50 percent.

This unanimous 75 basis point move was almost priced in by the US market, but the strong resolve to keep inflation under 2% sets the stage for more raises in the near future, which would worry emerging countries like India. The US Federal Reserve, which is well behind the curve, stated today that it is paying close attention to inflation threats. Fed Chairman Jerome Powell said that the Federal Reserve is also continuing the process of considerably shrinking its balance sheet.

Rising US interest rates provide issues for the RBI Governor, while domestic inflation shows indications of slowing. To boost GDP, the new inflation trajectory calls for a 35 basis point hike in the repo rate in August policy, but diminishing interest rate differentials between the US and India calls for a more aggressive 50 basis point hike to support the currency.

This is because the interest rate disparity between the US and India, which was around 3.75 percent during the two epidemic years, has now fallen to 2.40 percent. This will deter international portfolio investors from putting money into Indian debt and equities markets.

The consumer price index, or CPI, was 4.35 percent in September of last year, but it has risen dramatically this year, reaching 6.95 percent in March and 7.79 percent in April. The CPI is started to fall as a result of a little drop in commodity prices worldwide. It fell to 7.04 percent in May and 7.01 percent in June. The Governor of the Reserve Bank of India has indicated publicly that inflation appears to have peaked.

In terms of targeted inflation, India's headline and core inflation rates are currently substantially lower than those of the United States and the United Kingdom. The central bank of India has set a 4% inflation objective ( actual inflation at 7 per cent). In June, inflation hit 9.1 percent, above the 2% objective.

RBI releases discussion paper on climate risk, sustainable finance

RBI asks Urban co-op banks to review loan policy every financial year

RBI imposes major restrictions on 4 banks in the country, customers will suffer