GUWAHATI: the creation of the major change in the goods and services tax system, the GST Council on Friday moved 80 percent of items in the top 28 percent tax celebs to lower rates. Practicing from November 15, eating out could cost up to 13 percent less than before (GST rate cut from 18 percent to 5 percent) and whole sanitary fittings like shampoo, deodorant, chocolates, fans, furniture should get cheaper by up to 10 percent or more.

The top GST rate range of 28 percent will be imposed on Only 50 products, classified as the indulgence or luxury items like tobacco products, aerated drinks, and automobiles, when GST was imposed on July 1, more than 250 items were in the highest tax range. That's a decrease of 80 percent in the number of items in just four months and22 days. The total tax on numerous products still in the highest chunk will be higher than 28 percent as they also exert a pull on a cess.

The government also cheap the levy under composition scheme for traders and industry to 1 percent of turnover, with the additional reduction for those selling exempted goods.

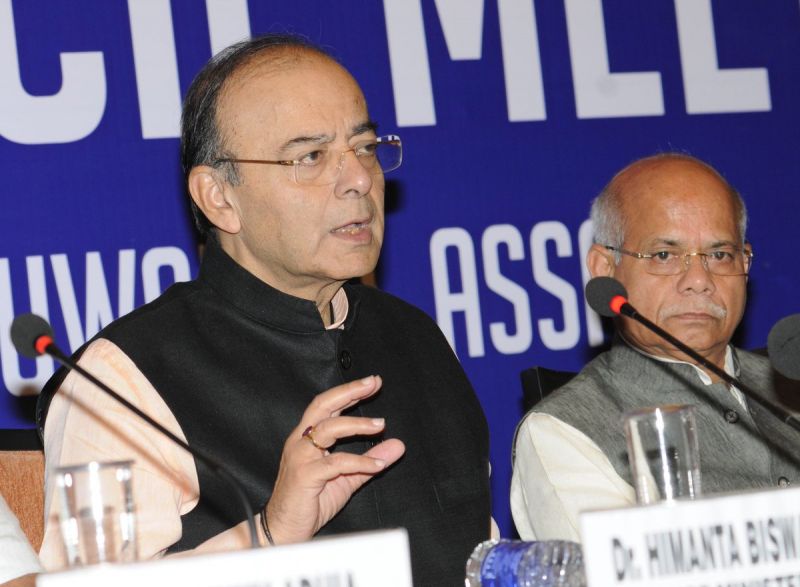

Finance minister Arun Jaitley asserted the rate alteration was part of the validation exercise embark on the last few months. “Some of them should not have been there (in 28 percent chunk). There are some items in which small players were exempted from excise (duty payment before GST was rolled out)," Jately said reporters after a seven-hour conference with the panel that has an illustration from all states and two union territories. A lower tax charge will transform into a decrease in prices of over 200 products.

The committee went beyond the references of the fitment commission consist of officers. The committee had suggested keeping 62 items in the highest range. The ministers, though, unnoticed demands for duty decrease from the construction zone and cement and paints will be in the 28 per cent slab.

"Rate decrease for 200-plus goods and services may recommend that there is resilience in tax collections," said Divyesh Lapsiwala, tax partner at consulting firm EY India, signifying that the revenue loss will be remunerated.