NEW DELHI: The Reserve Bank of India Governor Shaktikanta Das has come across gaps in corporate governance for a few banks, and it is essential that these gaps do not continue to grow since they could lead to volatility in the whole banking industry.

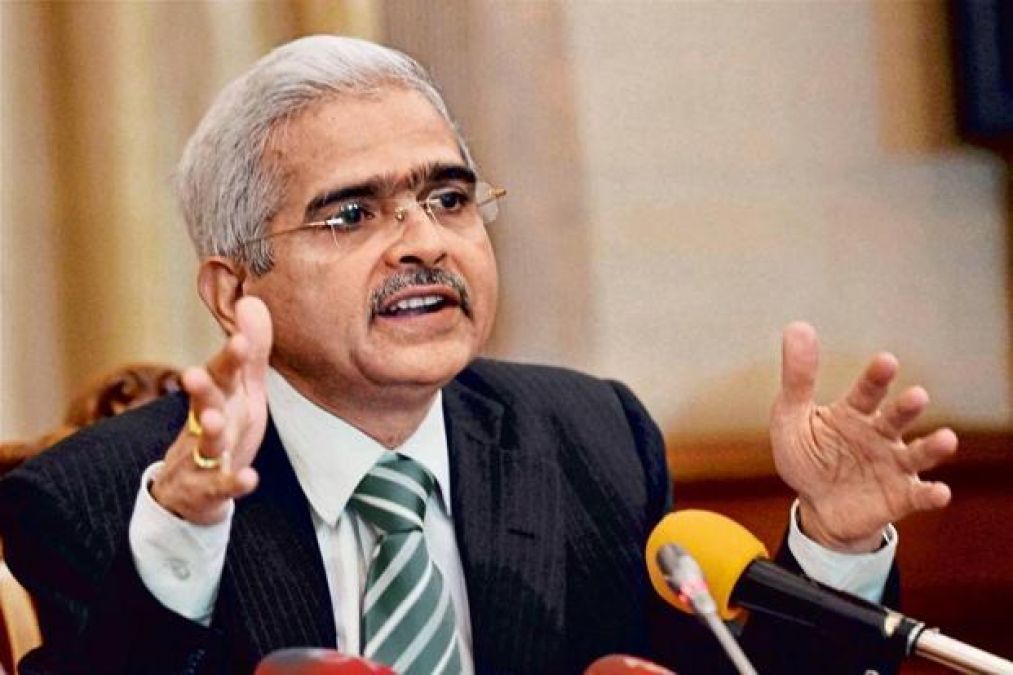

The Governor of the Apex Bank made the comments during the welcome speech at the Conference of Directors of Banks for Public Sector Banks, which was held in New Delhi on Monday, May 29.

While outlining some criteria for banks, Das stated that a strong governance structure is the first and most crucial condition for ensuring a bank's stability and sustainable financial performance.

The Reserve Bank of India has issued guidelines listing out 7 major themes which need to be discussed in the Board meetings, the RBI Governor said. They are their integrity, risk, compliance, client protection, financial inclusion, and human resources as well as their business strategy and financial reporting. In addition, the central bank has provided rules on the selection of a chairman, how board meetings should be run, the makeup of significant board committees, the age, tenure, and compensation of directors, and the nomination of full-time directors.

"It is, however, a matter of concern that despite these guidelines on corporate governance, we have come across gaps in the governance of certain banks, with the potential to cause some degree of volatility in the banking sector," Das added.

While these holes have been closed, it is essential that the boards and managements prevent further gaps from appearing. In his speech to the bankers, he said that strong governance in banks is the joint responsibility of the chairman of the board and the directors, including full-time and non-executive or part-time Directors. His address to the bankers came at a time when there has been instability in some banks in the United States.

After a run on the bank by depositors on March 10, Silicon Valley Bank, one of the most well-known lenders in the world of technology startups, first went down. As a result of its closure, other banks, including First Republic Bank and Signature Bank, were forced to close as well. The failure of a few small regional banks in the US has had an impact on the global banking sector and raised concerns about an economic chain reaction.

India Banking Sector stands out as strong and stable: RBI Chief