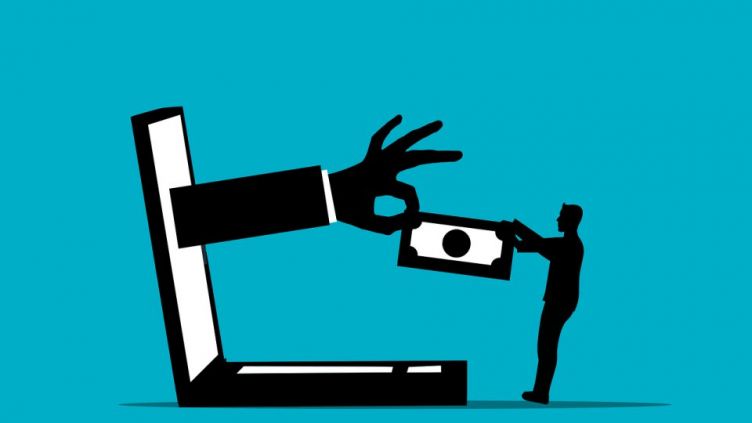

UPI users beware…a new cyber scam is here. A new innovative technique of the scammers to target the UPI users. You will have to enter the pin to check your balance after a withdrawal request by the scammer, one tap and all your money is gone. But what is the scam really, how can it harm you and how to escape from it? Let us have a look here-

What is the ‘Jumped deposit’ scam?

The United Payments Interface (UPI) is the most convenient method for making all your digital transactions. As easy it is, there comes the harm too. In the new, Jumped deposit scam, the scammer first makes an unsolicited small amount (e.g., Rs.5000) in the bank account of the user. The fraudsters basically try to exploit the curiosity of the recipient, that he will most likely believe that the amount has been transferred mistakenly. With that deposited amount they are able to access the latter’s funds.

After this, the scammer initiates multiple ‘withdrawal requests’ for a greater sum of money. This prompts the user to immediately check his bank balance. This is the bait that he falls to, and becomes a victim. As soon as he enters the PIN to check the bank balance by following their links, the scammer’s ‘Withdrawal request’ gets approved by default, within a moment the account is empty and all the money is gone.

How to escape from the scam?

There are a few ways, with which you can save yourself and the ones around you from this cyber fraud. Do any of these mentioned below and you won’t fall victim to the ‘Jump deposit’ scam:

Before you enter the pin to check your bank balance, wait. That too for at least 15-30 minutes before you check the balance. Within this time, the withdrawal request expires.

If you are still keen on entering the PIN and knowing what’s there inside, or simply want to fool the fraudster, then enter a wrong pin for the first time. By entering the wrong pin, it nulls the withdrawal request.

Or else, what you can do is:

Visit the bank nearest to you or contact your UPI service provider to verify the authenticity of the transaction. You will get to know, whether it is true or you are simply being duped.

Furthermore, you can lodge a complaint in Cybercrime by dialing 1930.

Also, stay educated and updated with the UPI functions, so that you never fall for such appeals that result in a fraud.

Why do people fall victim to such scams?

According to experts, there are plenty of reasons for which the people fall victim to such kind of scams. These can be:

It is the psychological manipulation that works behind, which leads the fraudster to successfully dupe the users. They play with the thoughts of curiosity, urgency and most importantly, the trust. People who lack awareness and aren’t much known about the functioning of the UPI fall for such emotional tactics. They feel it might be an error and feel the urge to return the money.

It starts with a smaller sum of money only, and follows with more. This is what makes for the easiest trap, a ‘hook’ that the user engages in to investigate. Even while returning the amount, the user fails to check the number and keeps on tapping to whatever comes; with this he loses the money.

The scammers purposely create a situation of panic, an urgency of the situation by cooking up a convincing story. People have a misconception that entering the pin verifies the balance, it won’t authorize any payments. Also, it is important to know about the difference between a notification for collecting money and a receiving money. You don’t need a PIN while receiving money.

Thus, it is necessary that you yourself stay wise and aware enough that these manipulations and tactics do not work on you.

After certain media reports doing rounds about the scam, the National Payments Corporation of India has issued some clarifications:

With this, you know all about the ‘Jumped deposit’ scam. So, make sure that you are able to save yourself as well as everyone around you from falling prey to the scam. Even if there are no reports as such, still if any situation arises you will be aware enough, no one can outsmart you. Ensure your safety and the others around you, do not give the fraudsters a slightest chance to take advantage over you. Stay cybersafe!