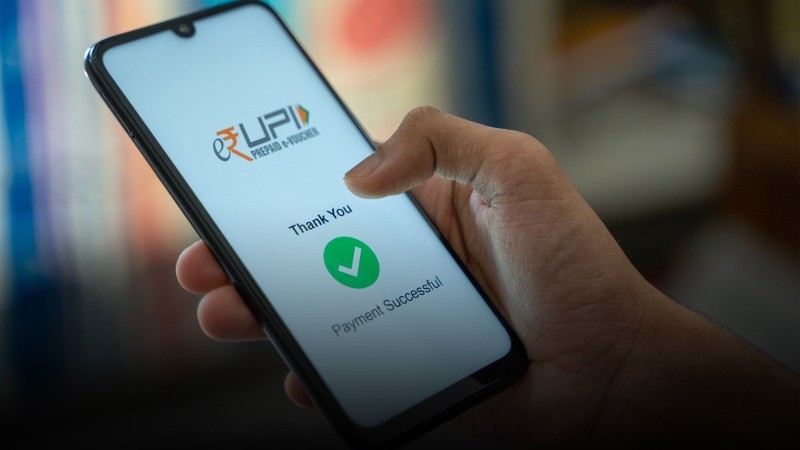

The President of Maldives, Mohamed Muizzu, has announced plans to implement the Unified Payment Interface (UPI) in the country, following a recommendation from the Cabinet. This decision was made after India agreed to share its expertise in digital and financial services during President Muizzu's recent state visit to India.

The introduction of UPI in the Maldives is expected to significantly benefit the nation's economy by increasing financial inclusion, improving the efficiency of financial transactions, and enhancing the country's digital infrastructure, according to a statement from the president's office.

The Cabinet’s decision was based on a report presented by the Minister of Economic Development and Trade, which was thoroughly discussed during a meeting. To facilitate the implementation of UPI, President Muizzu has proposed forming a consortium that will include banks, telecom companies, state-owned enterprises, and fintech companies operating in the Maldives.

This initiative marks an important step towards strengthening the Maldives’ digital public infrastructure and fostering collaboration with India in the field of financial technology.

Earlier, Prime Minister Narendra Modi emphasized India's commitment to supporting the Maldives, reinforcing the importance of their long-standing relationship. He stated, "Relations between India and Maldives are centuries old. India is the closest neighbor and a close friend of Maldives. The Maldives also has an important place in our 'Neighbourhood First' policy and 'SAGAR' Vision."

This development underscores the efforts of both countries to enhance cooperation and strengthen their ties for mutual benefit.

India Introduces Rupay Card in Maldives After Diplomatic Talks with PM Modi

Maldives President Mohamed Muizzu and First Lady Sajidha Mohamed Visit Taj Mahal