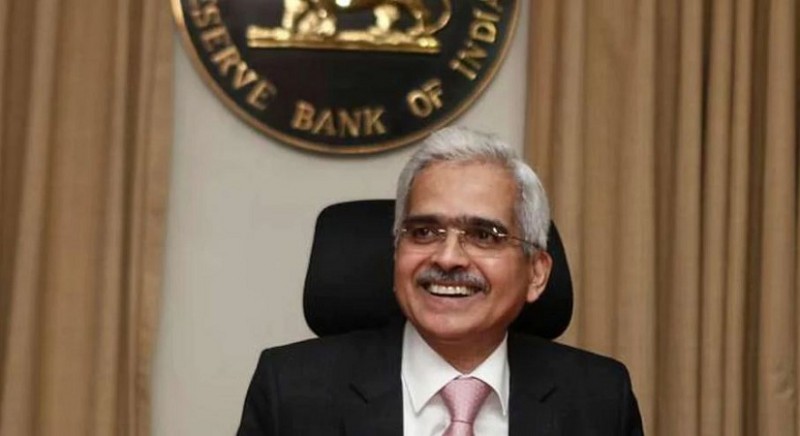

The next Monetary Policy Committee (MPC) meeting of the Reserve Bank of India is scheduled to commence on June 6. The MPC meeting will take place from June 6 to June 8. On June 8, RBI Governor Shaktikanta Das will announce the MPC's important decisions on key interest rates, the CRR, and policy changes.

Retail inflation, a key component considered by the RBI when determining monetary policy, rose for the seventh month in a row in April, reaching an eight-year high of 7.79 percent, owing to rising commodity costs, notably fuel, on account of the Ukraine conflict. For the past 13 months, wholesale price-based inflation (WPI) has been in double digits, reaching a new high of 15.08 percent in April.

"Expectation of rate hike is a no-brainer," Shaktikanta Das stated in a recent TV interview, "there will be some increase in the repo rates, but by how much I won't be able to tell now save to say that 5.15 may not be particularly precise."

Experts expect the central bank will raise the repo rate by 40 basis points after an off-cycle MPC meeting on June 8, in addition to the 40 basis points boost that took effect on May 4.

RBI launches annual survey on foreign liabilities, MF assets, and AMCs

India's economic growth slows to 4.1pc in March quarter

These big changes going to implement in June, direct impact on your pocket