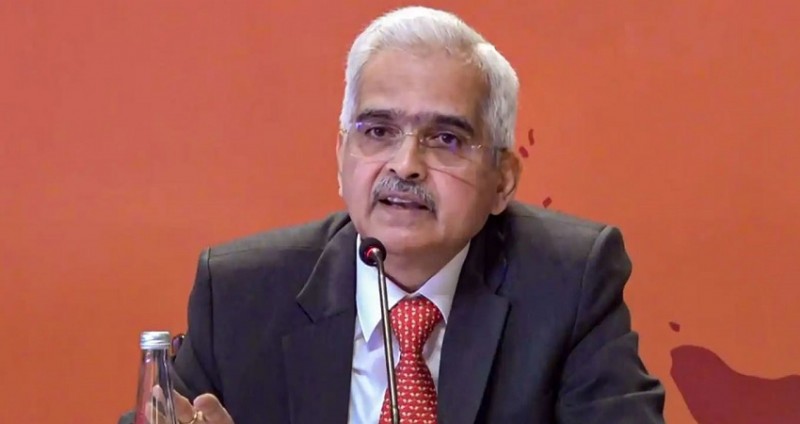

The Reserve Bank's team responsible for setting interest rates kicked off discussions today regarding the upcoming monetary policy changes. There's widespread anticipation that the central bank will maintain the current key interest rate, prioritizing efforts towards managing inflation as worries about economic growth ease. The verdict from the meeting, led by Reserve Bank Governor Shaktikanta Das, will be disclosed on Friday (April 5).

This marks the inaugural bi-monthly monetary policy session for the fiscal year 2024-25. Six meetings are slated for the year starting April 1, 2024.

Since the last increase in February 2023, when the RBI raised the repo rate to 6.5 percent, it has kept the rate steady across the six preceding bi-monthly policy announcements.

Analysts suggest that the Monetary Policy Committee (MPC) may look to global central banks, particularly the US and UK, which seem to be adopting a cautious stance on interest rate adjustments.

Switzerland recently lowered interest rates, becoming the first major economy to do so, while Japan, the world's third-largest economy, concluded its eight-year spell of negative interest rates.

"We advocate for the policy stance to continue withdrawing accommodation," stated a research report by India's largest lender, State Bank of India (SBI). The report also highlighted how rate actions by central banks in emerging economies often follow suit after similar moves by their counterparts in advanced economies.

"We see India as an exception... the first RBI rate cut is expected in Q3FY25," the report added.

Discussing expectations from the RBI, Dhruv Agarwala, Group CEO of Housing.com, predicted that the central bank would maintain the status quo on key policy rates due to robust economic growth. Despite a year-long decline in core inflation, inflation levels still hover near the upper limit of the apex bank's 2-6 percent target range, leaving little room for a rate cut in this policy cycle, he added. Agarwala also noted that stable interest rates would likely continue bolstering demand for housing in the country.

However, Vivek Singhal, CEO of Smartworld Developers, expressed optimism about a potential interest rate cut in the upcoming RBI meeting, seeing it as beneficial for India's real estate market. Such a move, he explained, would reduce borrowing costs, boost demand, and enhance investor confidence, potentially triggering growth and revitalization in the sector. Singhal emphasized that a lower interest rate environment would significantly improve sentiment among homebuyers, making homes more affordable.

India recorded an 8.4 percent economic growth in the December quarter of the previous fiscal year. The National Statistical Office (NSO) revised GDP estimates for the first and second quarters of this fiscal to 8.2 and 8.1 percent, respectively, up from 7.8 percent and 7.6 percent.

Other members of the Governor Das-led MPC include Shashanka Bhide, Ashima Goyal, Jayanth R Varma, Rajiv Ranjan, and Michael Debabrata Patra.

The government has tasked the RBI with ensuring that retail inflation, based on the Consumer Price Index (CPI), remains at 4 percent, with a margin of 2 percent on either side.

RBI Set to Decide on Interest Rates: What to Expect

US Fed's Mester Suggests Three Rate Cuts This Year Could Happen, Depending on Data