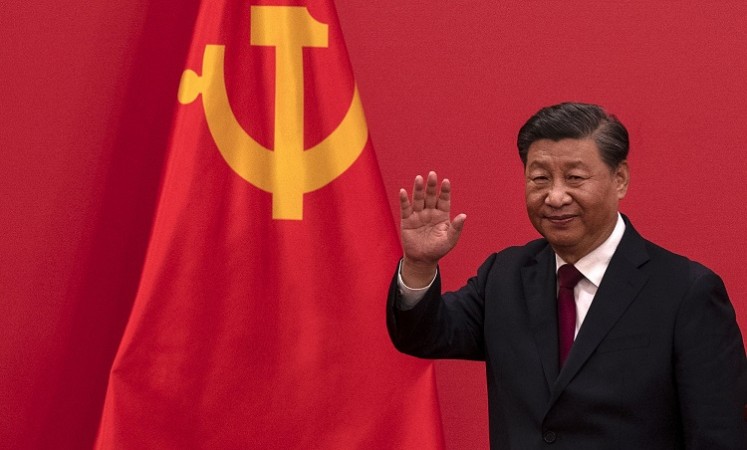

In a move to solidify his authority over China's $61 trillion financial industry, President Xi Jinping is poised to convene high-level discussions with state leaders and top financiers to chart the course for the next five years.

Held against the backdrop of historically low-profit margins in the banking sector and an ongoing anti-corruption campaign that has implicated over 100 officials and corporate leaders this year, Xi will preside over the biennial Financial Work Conference in Beijing on Monday and Tuesday, shrouded in secrecy.

Regarded as China's most influential leader since Mao Zedong, Xi is anticipated to prioritize the Communist Party's "centralized and unified" leadership and heightened oversight of the financial sector above all other policy goals, according to experts and scholars. Ensuring financial stability will also take precedence, as authorities strive to prevent economic sluggishness and the property market's troubles from further endangering the banking industry.

The upcoming conference has the potential to become a watershed moment for the financial sector, as highlighted by Bloomberg Intelligence economists led by David Qu, who commented, "A debt-laden property sector that’s threatening to rock the financial system adds urgency to the agenda."

This closely-watched gathering transpires at a pivotal juncture for China, marked by mounting inquiries into the nation's political and economic trajectory. Much of this uncertainty is fueled by Xi's expansive crackdown on various segments of the private sector, prompting foreign investors to withdraw their capital at an unprecedented rate. Even Wall Street giants like Goldman Sachs Group Inc. have scaled back their ambitious expansion endeavors.

Originally slated for last year, the conference was postponed due to China's stringent "Covid-zero" approach. It was first instituted in 1997, following the Asian financial crisis, with the overarching objective of advocating for financial reforms that support economic growth and safeguard stability. In recent years, its significance has surged, with the most recent iteration in 2017 being personally presided over by Xi, in contrast to previous editions overseen by China's premiers.

Key topics that are expected to dominate the agenda include Xi's efforts to underscore recent changes. Earlier this year, the financial industry's oversight structure was revamped, with the establishment of a larger national regulatory body and a transfer of certain responsibilities from the central bank to a body controlled by the Chinese Communist Party.

The CPC has solidified its grip over the financial sector through its anti-corruption campaign and regulatory adjustments, asserted Sheng Songcheng, a former director of the People's Bank of China's statistics and analysis department, adding, "The meeting will undoubtedly place the leadership of the Party’s Central Committee over all financial work at a prominent position."

Xi has also been urging the finance industry to reduce executive salaries and curb what a leading body labeled as "hedonistic" practices, aligning with his flagship goal of "common prosperity." The Chinese leader has further extended the Party's influence over the sector by promoting an ideological drive that requires bankers to study his writings extensively.

Stability and mitigating risks are of paramount concern. Analysts believe that it is crucial for authorities to delineate a clear direction at the conference to address debt issues and avert a potential crisis, with regulators likely intensifying oversight to limit moral hazards.

In the past year, Beijing has called upon the nation's largest banks to shoulder some of the burden by offering credit support to distressed real estate developers and local government financing vehicles, which are burdened by a colossal $9 trillion debt. The growing exposure of these institutions has raised alarms among some analysts who fear it could impede systematically important banks.

China is also expected to hold local governments accountable for addressing existing hidden debts and preventing the accumulation of new illicit liabilities, as noted by Liu Xiaochun, deputy director of the Shanghai Finance Institute think-tank.