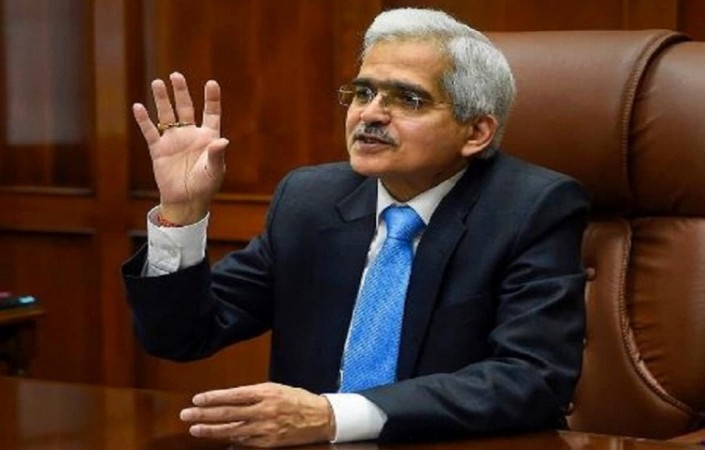

RBI Governor Shaktikanta Das said the central bank will come out with discussion papers on adopting expected loss-based approach for loan loss provisioning and on securitisation of stressed assets framework.

The discussion papers on the above two issues will be issued by the RBI, HE said on Friday while announcing the bimonthly monetary policy. He also said new guidelines on the regional rural banks permitting internet banking facilities to their customers will be issued soon.

According to Das, the proposed guidelines for securitisation will be in addition to the ones that are in trend. In September 2021, the RBI had issued the revised framework for securitisation of standard assets. As regards securitisation of non-performing assets, the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, currently provides a framework for such securitisations to be undertaken by Asset Reconstruction Companies (ARCs) licensed under the Act.

However, based on market feedback, stakeholder consultations and the recommendations of the Task Force on Development of Secondary Market for Corporate Loans, it has been determiend to introduce a framework for securitisation of stressed assets besides the ARC route, akin to the framework for securitisation of standard assets. This in part has been due to the preference of banks shifting to alternative avenues, with asset sales declining as a proportion to outstanding gross non-performing assets across bank groups, said Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, SBI.

RBI Governer clarifies Indian Rupee is free-floating currency